Looking back at the financial mess I created, I can honestly say that I regret buying a timeshare more than any other decision in my life. It started with a promise that sounded too good to be true. My wife and I were walking through a mall in Orlando when a friendly woman offered us free tickets to Disney World. All we had to do was attend a “brief” 90-minute presentation at a nearby resort. We thought we were smart. We told each other, “We will go, eat their free breakfast, say no to everything, and get our free tickets.” We had no idea we were walking into a psychological trap.

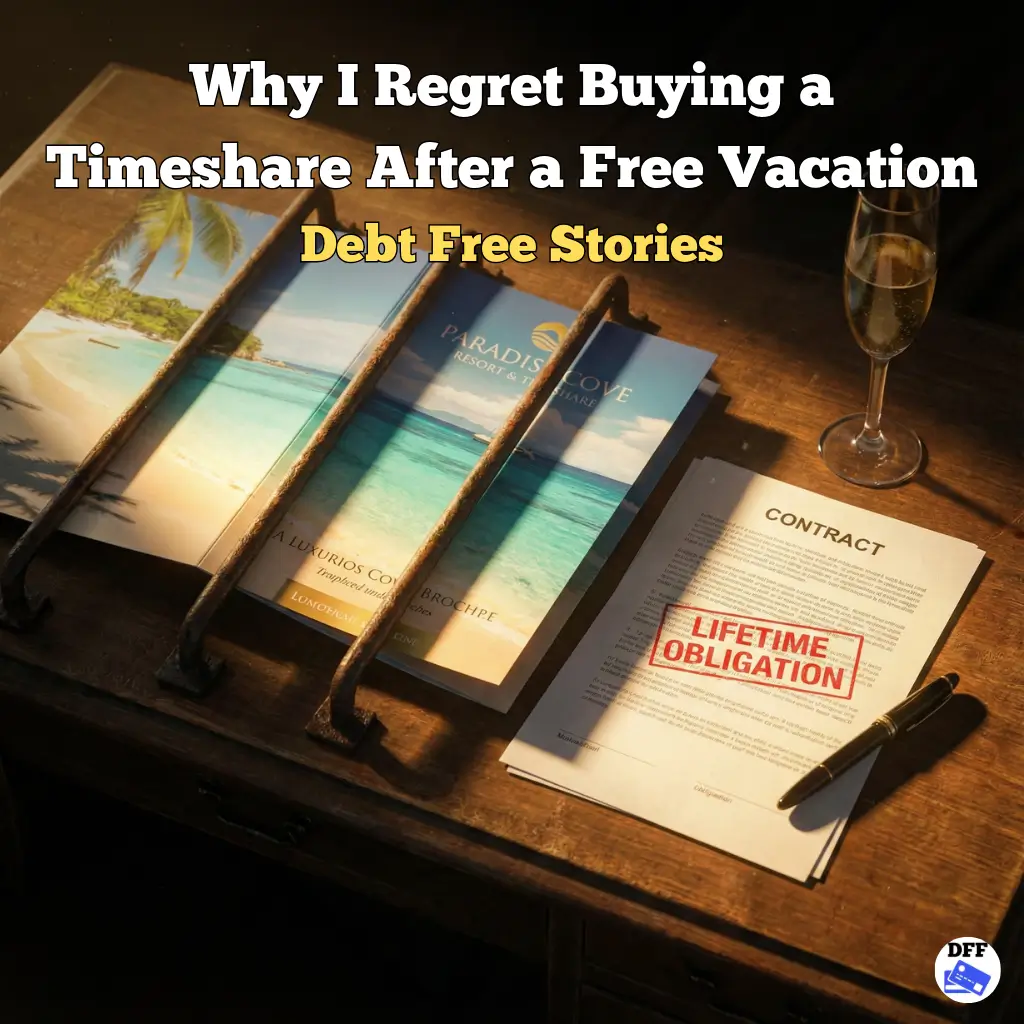

The presentation wasn’t 90 minutes; it was four grueling hours. We were locked in a room with aggressive salespeople who systematically broke down our defenses. They showed us photos of luxury suites and compared them to “dirty” hotels. They served us champagne and made us feel special.

When we tried to leave, they brought in a “manager” who offered us a “one-time-only price” that would expire the moment we walked out the door. Exhausted, hungry, and emotionally manipulated, we finally broke. We signed a contract for $20,000, financed at a high interest rate, thinking we had just bought a piece of paradise.

The Reality Sets In

The nightmare didn’t start immediately; it was a slow burn. The first year, we tried to book a vacation, but the dates we wanted were blacked out. The “flexibility” they promised was a lie. Then, the bills started arriving.

It wasn’t just the monthly loan payment of $350. It was the “Maintenance Fees.” We were shocked to receive a bill for $900 in January for “upkeep,” a fee that the salesperson had barely mentioned. We quickly realized that these fees go up every single year, regardless of whether we used the unit or not.

By year three, we were drowning. The maintenance fees had jumped to $1,200, and we were still paying off the original loan. We were paying thousands of dollars a year for a vacation property we couldn’t even use. We tried to sell it, only to discover the brutal truth: timeshares have zero resale value. I found listings on eBay where people were selling their contracts for $1 just to escape the fees, and nobody was buying them.

We felt trapped. The financial stress was causing arguments at home every time a bill arrived. We realized we had signed a contract for infinite debt.

Desperate to get out, we stopped paying. We knew it would hurt us, but we couldn’t keep bleeding cash. The timeshare company was ruthless. They called us daily, threatened legal action, and eventually reported the default to the credit bureaus. My credit score took a massive hit, dropping over 100 points.

It took us two years of fighting and working with a specialized exit team to finally sever the contract. The damage to my credit report is still there, slowly healing, but the relief of not owing those annual fees is worth it. If you are ever offered a “free vacation” in exchange for a presentation, run. There is no such thing as a free lunch, and that free weekend could cost you decades of regret.

Be careful what you sign. A timeshare isn’t the only signature that can destroy your financial future. [Read: The Co-Signing Nightmare] to see how helping a family member can be just as dangerous as a salesperson.

[…] – 09Dec2025 Exit Strategies Why a Starter Emergency Fund Beats Paying Debt Credit Nightmares Why I Regret Buying a Timeshare After a Free Vacation […]

[…] Falling for a sales pitch promising a dream life isn’t unique to the internet. Sometimes, the trap happens while you are on vacation. Read about another massive financial mistake in this confession about regret buying a timeshare. […]